Let us know the the RBI latest repo ratem bank rate, reverse repo rate and Marginal Standing Facility Rate w.e.f. 8th June 2022.

The repo rate raised by 50 basis points to 4.90 percent from 4.40 percent previously. The repo rate was last increased in May 2022 by 40 points, and it has been constant since then. The hike will take effect immediately. The Cash Reserve Ratio (CRR) has also been increased by 50 basis points, putting further upward pressure on interest rates. Borrowers could expect higher EMIs, while FD investors might expect higher returns on new FDs.

Table of Contents

RBI Repo Rate 08.06.2022

| Repo Rate | 4.00% |

| Bank Rate | 4.25% |

| Reverse Repo Rate | 3.35% |

| Marginal Standing Facility Rate | 4.25% |

- RBI-Reserve Bank of India.

- Repo- Repurchase Agreement or Repurchasing Option.

- MRF-Maginal Standing Facility.

- CRR – Cash Reserve Ratio.

- SDF- Standing Deposit Facility.

- CPI-Consumer Price Index.

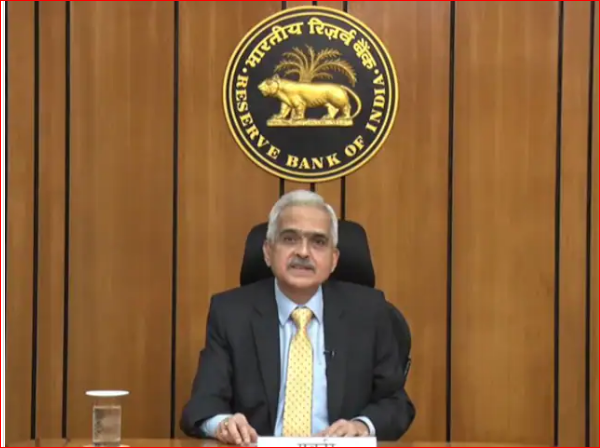

Who is RBI Governor

On December 12, 2018, Shri Shaktikanta Das, IAS Retd., former Secretary, Department of Revenue and Department of Economic Affairs, Ministry of Finance, Government of India, took over as the Reserve Bank of India’s 25th Governor. Shaktikanta Das is a retired 1980 batch Indian Administrative Service officer of Tamil Nadu cadre.

What is REPO Rate?

The Reserve Bank of India (RBI) loans money to commercial banks at a rate of interest known as the repo rate. The term “repo” refers to a repurchase agreement or a repurchasing option. By selling qualified securities, banks can obtain loans from the central bank (the RBI). The central bank and the commercial bank will reach an agreement to repurchase the securities at a set price. When banks are short on funds or need to maintain liquidity under volatile market conditions, this is done. The repo rate is used by the RBI to keep inflation under control.

What is Bank Rate?

The bank rate is the interest rate that a central bank charges when lending money to a commercial bank. A bank can borrow money from a country’s central bank in the event of a fund shortage. That would be the Reserve Bank of India in India.

What is Reverse Rate?

The reverse repo rate is the rate at which a country’s central bank (in this case, the Reserve Bank of India) borrows money from domestic commercial banks. It is a monetary policy tool that can be used to control the country’s money supply.

What is Marginal Standing Facility Rate?

The MSF rate, or Marginal Standing Facility rate, is the rate at which the Reserve Bank of India lends money to scheduled commercial banks that are experiencing severe liquidity shortages. Banks can obtain overnight cash from RBI by paying the exclusive MSF rate, which differs from the Repo rate.

Read also..

- YouTube Video Thumbnail: Very easy to Set / Add on Mobile.

- UAN, e-Nomination, Claims and Death Settlement of EPF Member.

- Chrome privacy error-your connection is not private.

- Steps to remove Youtube Strike.

- How to Check and Block Spam Messages, Mail and Call.

- Easy way to earn money online.

- How to remove excess ice from freezer.

- Gmail access.

- How i know that my post is indexed or not.

If you liked our article, you can comment on it in the comments box below and also share this post with your friends.

Subscribe so that we will bring you more such articles in the future. Thank you.

Have a good day. God Bless You.